A Beginner’s Guide to Venture Capital Funds

You have heard of venture capital funds before, but do you know how they work? Let's break it down to basics, from fundraising to value creation.

Blockchains record value. They are simply a ledger that can track the balance of a standardised unit of value

For all of human history, the concept of value has existed. Hard to define, but easy to grok. Essentially, it is about trading something in exchange for something equal or better. For our ancestors, this may have been about exchanging grain for fur. Value was inherently subjective, for someone that is more hungry than cold, the meat is more valuable.

But as we evolved, we created units of standardised value, currencies. One token was worth exactly the same as another. It started out as shells, then progressed to electrum coins, and now we are at the next evolution — cryptocurrencies.

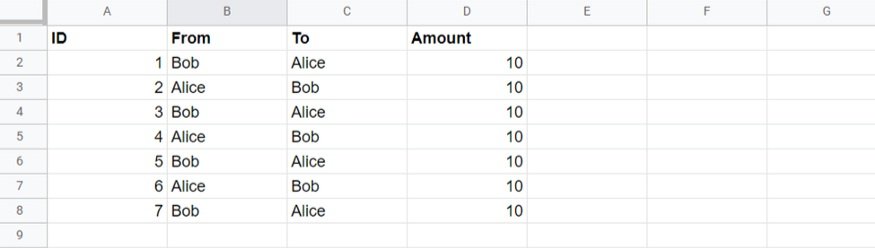

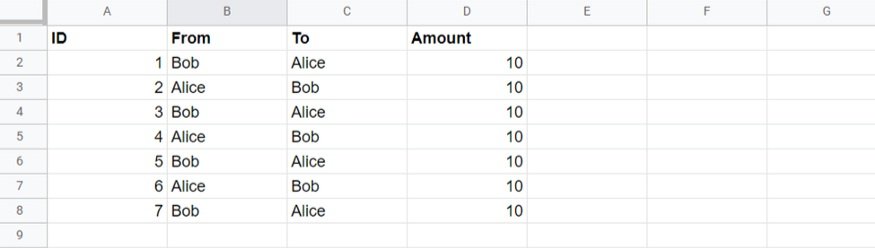

Blockchains record value. They are simply a ledger that can track the balance of a standardised unit of value. Bob owns X units & Alice owns Y units. This is why many people describe blockchains as just a new type of data structure. It’s a bit more complex than that when we introduce state changes, but it’s a good starting point.

Some have also used the analogy of a giant Google sheet that everyone in the world can edit while being almost certain that it is accurate and honest.

In many ways, this is a good representation of a blockchain — anyone can add a row to the sheet and everyone can see it at all times. It can also be used to track value over millions of rows by counting balances after each transaction.

From this chain of transactions, the exchange of value can be closely monitored, with everyone’s balance being clear at all times. In the beginning, Bob transfers Alice 10 units via several transactions.

Bob never needs to know Alice for it to work.

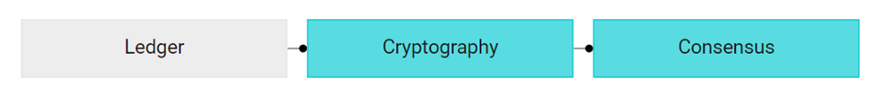

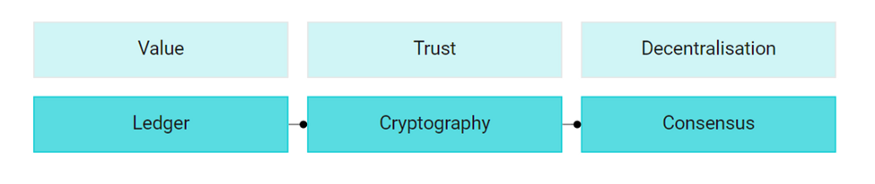

There are still questions left unanswered by this analogy such as how do we prevent people from fraudulently editing transactions to benefit themselves, and how does everyone approve each new transaction? We will answer these later in the series with our next two instalments on cryptography and consensus. Together, these three parts form the basis of understanding of any type of blockchain.

Many of the technical descriptions online lose sight of the simplicity and beauty of blockchains.

Each of these components results in a specific core value proposition. The ledger allows value to be moved. Cryptography means it can be done with trust. And consensus ensures that it is decentralised, so it is secure from attack & censorship.

For now, we will focus on the ledger.

Public blockchains can be viewed by anyone at any time. They are not hosted by one company or a server but instead exist on computers all over the world. Neither is there one company in charge of maintaining it, they are maintained by many people.

A key property of these ledgers is that they are immutable. Once a transaction has been verified and stored on the network, it cannot be altered without altering the entire blockchain itself. It’s as if altering a single letter in the book would change every single other line into a completely new sentence.

Another key property is that the entire history of transactions is stored on each node in the network. Every transaction can be traced and monitored. Compare this to legacy finance systems where there is no visibility. But this can be extended to the ownership of any assets. There is limited visibility in ownership records of everything from cars to artwork.

It’s difficult to know who has owned those assets before and if they have done what they say they have. With blockchains, no longer is it their word against yours, it’s immutable, indisputable for everyone to see.

An immutable ledger, is arguably the greatest method humans have created to exchange value between each other. It doesn’t rely on trust, is reliable and secure.

Many people think that digital currencies are the only value that can be exchanged on a blockchain. The reality is that this type of ledger can be used to record anything of value to humankind. Medical certificates, land titles, bank guarantees, identity documents, artworks and more. All can benefit from being secured on an immutable ledger that is cryptographically verified. Most of the world’s information is yet to migrate to this new type of data structure, but it is well underway.

Take, for example, our portfolio company from Australia - Lygon. They take bank guarantees and put them on this immutable ledger, a private blockchain. Historically, it used to be settled by paper between three parties — the issuer, the guarantor, and the guarantee. Every time the document needed to be altered, the physical copy had to be transported between the parties. Besides being time-intensive, it wasted 4 million pieces of paper per year. Now all three parties can store this data on a blockchain and be confident that it is immutable and unaltered by the other parties.

We are very interested in the different types of value that will be represented on this new ledger. NFTs are the most recent craze and an example of the blockchain’s application in value exchange. We will cover them in a future instalment, but they are basically, unique digital assets that cannot be replaced by another one. Some might call them simple JPEGs or GIFs where you can trace their entire ownership history from the true owner to the present day.

Value exchange is such a fundamental part of human existence, and we have now found a means of exchange that is sure could change the way our species interact with each other.

This article was written by Eric Tran, Associate at Aura Ventures, and originally appeared on Medium. You can follow Eric for more articles regarding blockchain, Web3, and funding here.

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

You have heard of venture capital funds before, but do you know how they work? Let's break it down to basics, from fundraising to value creation.

In many ways our resumes are like a share price, disconnected from our intrinsic value but something that everyone else speculates on.

We believe that seeking relative value across markets and different asset classes will provide more stable risk adjusted returns for investors.

Subscribe to News & Insights to stay up to date with all things Aura Group.