Eyes on the Horizon, Heads Down in Focus: 2024 Year in Review

Aura Group remained heads down in our mission, to drive meaningful progress for our investors, team, and portfolio.

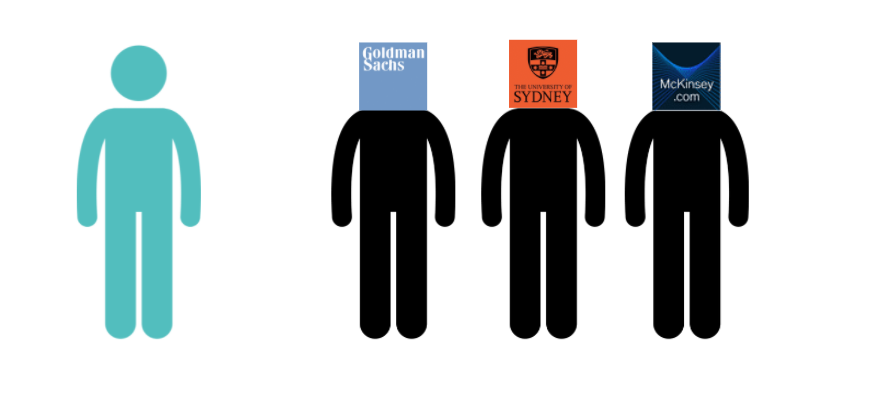

In many ways our resumes are like a share price, disconnected from our intrinsic value but something that everyone else speculates on.

In many ways our resumes are like a share price, disconnected from our intrinsic value but something that everyone else speculates on.

These symbols act as a signal in resume land, inflating everyone else’s speculation of our ability.

These signals are so strong because we have so much faith in the filtering mechanisms of these organisations. It implicitly means you have proven a level of competence that makes you in the top 0.01% of candidates selected. You have passed the IQ test with flying colours and probably have a healthy amount of EQ as well.

But that’s the problem.

Everyone assumes this to be true, so generally most people with a resume that has strong signals become overvalued relative to actual ability.

If everyone wants to buy something, the price goes up, even if the underlying thing doesn’t change. The bidding war occurs because people rely on outsourcing their filtering mechanisms to these prestigious institutions. If they worked at McKinsey, good enough for us.

Put another way, if everyone hires the same way, everyone will overvalue people in the same way.

That’s not to say that management consultants or ex-bankers aren’t very talented people, the confidence interval that they will be talented is very high but still far from perfect. The problem is that everyone competes for the small pool of talent where these overused signals drown out other, often much more capable people.

A person who graduated from TAFE but can build amazing UX/UI is probably more useful to a startup than someone who spoke at the model UN while competing at the Olympic Games and receiving their PhD in ancient history.

I made the mistake early on of thinking signalling was important. I went to Uni and did a degree that was perceived as prestigious. Many hiring managers would have inflated my ability based on my resume, in reality, I was completely incompetent at pretty much everything.

I had no skills which translated to being useful, all my skills translated into how to do the specific thing that was required to send the signal. I was overvalued and underperformed.

If every organisation had an unlimited cheque book, maybe the best strategy would be to hire purely based on these signals as you could overpay for the high probability that you are hiring good talent — although it doesn’t guarantee success. But in reality, everyone has constraints that raise the question of how you can find overlooked talent that no one else spots. How do you avoid competing for the same small pool of talent that all companies compete for — the Ivy Leagues, the Ex-Googlers, the [insert name] Unicorn alumni.

Note: As will all my blogs, I am wildly unqualified to write this article, I haven’t hired someone in my life. Please indulge me.

Although there are some archetypes of people I think are systematically overlooked and are the best types of people to hire:

If anything drops someone’s value in resume land, it’s being fired. A negative signal reverberates far and wide that this person is to be avoided like the plague. While there will often be a good reason to avoid that person, many talented people are let go.

Here is a list of them:

Steve Jobs

Oprah Winfrey

JK Rowling

Walt Disney

Thomas Edison

There are many different flavours of capable people getting fired — the highly disagreeable but brilliant (Steve Jobs), not interested in the company’s mission (Thomas Edison) or the company just got it plain wrong (Oprah Winfrey). Regardless of the type, letting someone go can inject that person with rocket fuel to prove people wrong.

If you can understand the root cause of why someone got fired, and you can work around it, you provide someone with a platform to work harder than they ever have before to prove a point

“A great pleasure in life is doing what people say you can not do” — Walter Bagehot

AI software is often the misinformed gate keeper for a lot of large businesses. It screens applications based off one metric — university marks. Doing badly at Uni can often be a great signal. It could mean someone has thought the opportunity cost of good grades were not worth it and spent their time on something more meaningful.

There are a million unproductive, productive ways to spend time like making a short film, writing a fantasy novel, creating a website, drop shipping or even writing a business blog that three people read.

Someone who did badly at Uni, because they were interested in something else, shows an innate curiosity, independent thought and hard work. To do well at Uni you can get by with just one — hard work.

I think this heading should be reformulated to look for someone who has done badly at Uni because they were doing something interesting.

Or even better, hire someone who didn’t go to Uni. Either the existential angst of not conforming drove them to independently learn and master a skill or they don’t care about societal norms and are hell bent on changing the world for their stubborn master plan of humanity. Both are great.

Almost all immigrants who arrive in a new country are disadvantaged in the signalling game. Whether it be because they don’t have the money that goes into acquiring strong signals such as paying for university or working unpaid internships, or maybe they just don’t have the network that others do.

As a consequence, they are overlooked. Not only does this extrinsically undervalue them but it fails to reflect the intrinsic drive that many possess as a product of their circumstance.

If someone’s livelihood and often their families are dependent upon them achieving a certain goal, they will obviously have far more hunger and drive than most people.

I think Chamath would agree.

In every office building, there are hundreds of highly introspective human beings who have been confined to scrolling through documents for hours on end for no apparent purpose. These companies are often boring in stagnant industries. There are dormant skill sets waiting to erupt at the right opportunity.

What if Jim didn’t have to sell paper?

Creativity is one of the few skillsets where traditional signalling is inversely correlated to ability. You don’t need art school to be a good artist, it may even detract from being one. Repressed creatives are everywhere.

I’m not trying to write the type of article that says everyone should walk into the sunset happily ever after because everyone is amazing. Instead, I am trying to make the case that our simple heuristics for hiring talent need to change. Great people are being systematically over looked because we rely on signals, not substance.

In terms of actionable ways of capturing more of this undervalued talent, I think the following are good places to start:

1. Anonymise the initial part of the hiring process with software like Applied. This eliminates signalling and forces HR managers to engage solely on substance.

2. Look for people with chips on their shoulders, people who have been rejected, overlooked and underestimated. It could be as simple as making it a hiring question — who do you want to prove wrong and what are they wrong about?

3. Remove any university requirements for the job (lawyers, doctors & pilots may be good exceptions)

4. Hire employees from anywhere in the world

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

Aura Group remained heads down in our mission, to drive meaningful progress for our investors, team, and portfolio.

Paul brings with him over 20 years of experience in the financial services industry and his expertise covers all asset classes.

We are thrilled to announce the appointment of Dan Annan as our new Distribution Director. With a career spanning over two decades in the financial...

Subscribe to News & Insights to stay up to date with all things Aura Group.