Tokenisation: The Next Frontier for Private Equity?

There have never been many questions about private equity’s relevance in global markets as an asset class.

Software is eating the world, but how many bites are left? Many are quick to say that all the obvious internet ideas are gone

Software is eating the world, but how many bites are left? Many are quick to say that all the obvious internet ideas are gone — online encyclopedias, online shops & even online matchmaking.

But is this actually true?

The largest gold ingot in the California Gold Rush was 72kg. It was stories like this that fuelled a migration of over 300,000 hopefuls to California in the mid-1800s. Many continued to arrive in California in search of opportunity but found a dwindling supply of gold and a swelling number of miners. The land of opportunity had been mined, there were no big gold ingots left.

Is the internet economy following a similar trajectory? Are there any big undiscovered ideas?

I think a better analogy than gold mining is apple picking. Gold is a commodity with fixed supply, internet ideas are not (just like apples). The short answer to this question is yes, the apples are ripe and many more seeds have been planted.

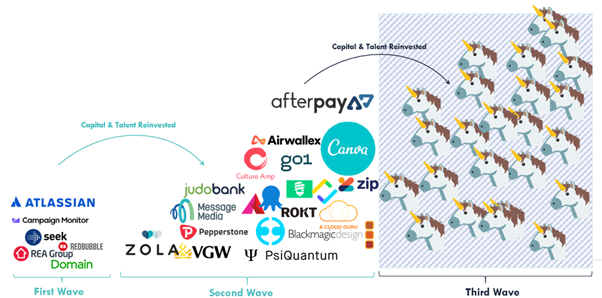

In 2020, there were 65 unicorns that went public or got bought. In 2006, there was just one.

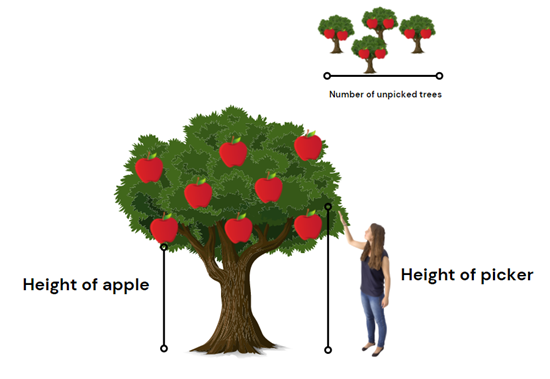

The number of big apples is accelerating exponentially. Perhaps the more interesting question is how does one look for apples? We can create a very basic equation for modelling how likely it is to pick fruit from the trees. The likelihood of picking an apple is equal to:

(height of the picker/height of the apple) * number of unpicked trees

The bigger the number, the more likely apples will be picked.

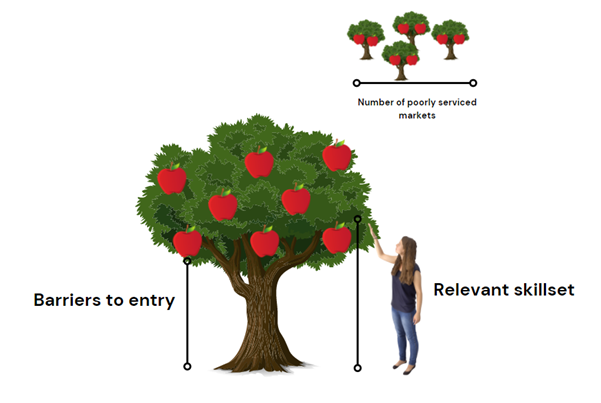

In non metaphor terms, the likelihood of finding a profitable idea:

= (relevant skill set/barriers to entry) *number of poorly serviced markets

Basically, someone’s skill set must overcome the barriers to entry for a poorly serviced market. Let’s break down each component of the equation:

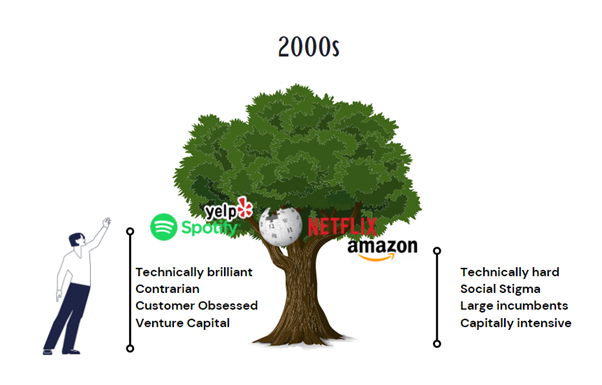

Different ideas require different skill sets. Building a trash removal company might require resilience, charisma and conscientiousness. Building the most powerful search engine might require no charisma but pure technical brilliance.

Barriers to entry are the things that prevent people from solving a problem for others. They can be perceived or actual. Each market will have a unique set of barriers that must be surmounted. These commonly include:

Technical difficulty

Capitally intensive

Large incumbents

Consumer inertia

Artificial barriers.

The key is that the relevant skill set is capable of overcoming the barrier to entry.

Technically brilliant > Technical difficulty

Resourcefulness > Capitally intensive

Customer obsessed > Large incumbents

Hustler > Consumer inertia

Contrarian > Artificial barriers.

Note: I haven’t included competition in the equation as it is already factored in by barriers to entry. The more barriers, the less competition.

The tree must bear fruit, just as the market must have customers who would pay for the idea. The more people that have problems, the more opportunity for ideas to solve them.

But why is this equation useful? It seems very abstract and academic, a dangerous combination. For me it provides a useful framework to think about opportunity.

In the early age of the internet, there was a seemingly infinite number of problems that could be solved by simply digitising legacy businesses. These were the first ideas to go, the low-hanging fruit if you will.

Pickers then went after the highest margin, lowest operational complexity and strongest market pull businesses; search, social networks, CRMS, e-commerce.

The third wave of internet companies shifted to more operationally complex and lower margin businesses — Uber, AirBnB & Stripe.

As the forest became crowded, opportunity came from looking higher.

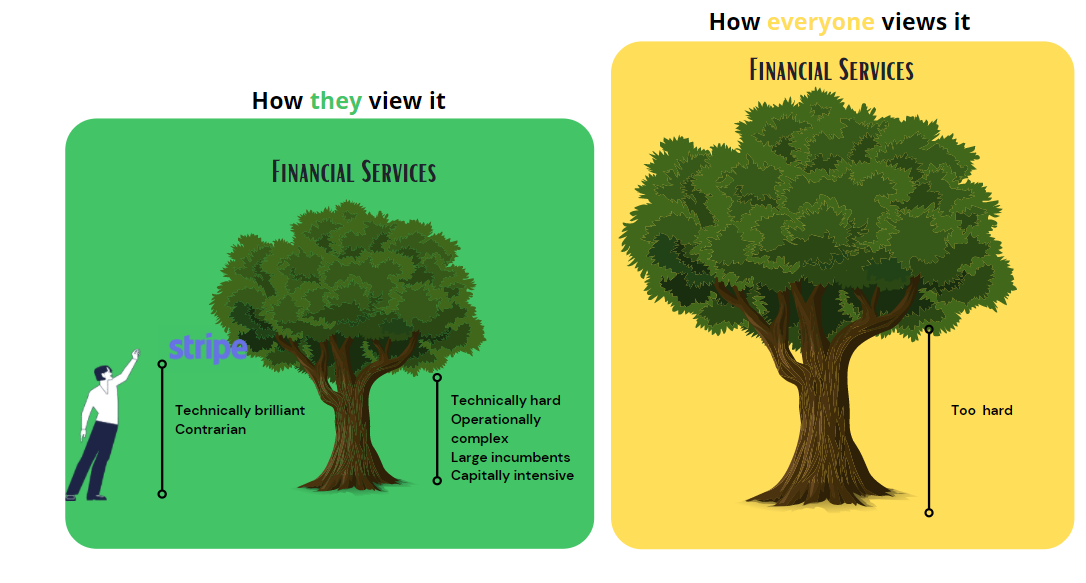

Using Stripe as an example, everyone could tell you that paying for things over the internet was a horrible experience. Everyone could see the tree. But very few entrepreneurs wanted to go near financial services in 2009 because it was perceived as too difficult. Patrick and John Collison had the technical ability to overcome these perceived and actual barriers in a poorly served market.

Stripe is now worth roughly USD 95 billion.

If everyone picking apples was different, everyone would look in different places.

In reality, the average entrepreneur has historically been a 40 year old male with an interest in technology from Silicon Valley.

Thankfully, this is changing but not quickly enough. It has meant that startups are often biased towards solving a narrow domain of problems. There are no shortage of productivity apps, investing platforms and developer tools. Contrastingly, there are many over looked problems such as female reproductive health, banking for the poor and solving food shortages around the world. There is great opportunity in serving the large masses of people who have been poorly served.

Here are some examples:

Ovira: Alice Williams had debilitating period pain so created a device that used TENS to reduce pain.

Halter: Craig Piggot grew up on a Dairy farm and saw his parents working 20-hour days. He made a collar that can remotely guide cows for farmers.

Nubank: David Velez experienced first hand just how neglected poor Brazilians were by the banking system so he founded a bank for them.

I think there will be many more stories of founders who have a unique insight into a previously neglected group of people, making wildly successful companies.

Low-hanging fruit is in the public lexicon because some ideas are easier than others. There are few barriers to entry for starting a pure software business such as a consumer app or a SaaS tool. As a result, a lot of the good ideas in these categories have already been picked. Multiply the number of shower thoughts by people in the world and almost every marketplace and social media app has been thought of before.

But that doesn’t mean some won’t work….

Facebook and Google are always just one startup away from non-existence.

The only way to compete is by having an exceedingly amazing product.

Think Clubhouse in consumer social, Brave in search engines and Airtable in spreadsheets.

I think in the future there will be a lot of these mercenary-style companies created with the sole intention of beating out not only legacy incumbents but even other venture-backed startups (Look at Pitch funded by Index Ventures challenging both Canva and Powerpoint).

Potential barriers to entry might not be as high as they look or alternatively, they are in the process of being reduced.

Historically, these have been some causes for a reduction in tree heights:

Less legal barriers> Australian fintechs in 2017

Less capitally intensive> Cloud computing in 2007

New technology where incumbents can’t counter position > Crypto in 2021

Rapid consumer education > Cleantech in 2021

Timing is really just another way of saying that entrepreneurs went after a market just as the barriers to entry were changing. It may be that consumers are finally willing to buy or that a new technology emerges that a competitor can’t use.

As the internet matures further, my prediction is that startups will go after markets with higher and higher barriers to entry — synthetic biology, pharmaceutical development & legal services.

Ultimately, I have no idea.

But it’s safe to say the internet isn’t a gold rush, it’s an orchard of apple trees that have just been planted.

This article was written by Sean Stuart, Investment Analyst at Aura Ventures, and originally appeared on Medium. For more from Sean, you can follow him here.

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

There have never been many questions about private equity’s relevance in global markets as an asset class.

Not all fund managers are built equal, just like not all markets are equal.

In many ways, blockchains are like democracies. The system only works if there are lots of people who come together and vote

Subscribe to News & Insights to stay up to date with all things Aura Group.