Aura Private Credit Weekly Insights - 4 November

This current economic environment is heating up, with employment and inflation levels reaching all-time highs in the post-pandemic environment.

This current economic environment is heating up, with employment and inflation levels reaching all-time highs in the post-pandemic environment.

The Aura High Yield SME Fund aims to provide investors with stable and consistent returns which are uncorrelated with public markets through the purchasing of notes in Australian SME lender warehouse funding facilities. Due to the fund’s underlying exposure to Australian SMEs and the adverse impacts the COVID-19 pandemic has had on the sector, this weekly letter aims to provide current and prospective investors with regular updates on relative news and portfolio commentary.

This current economic environment is heating up, with employment and inflation levels reaching all-time highs in the post-pandemic environment. Monetary policy intervention may come sooner rather than later.

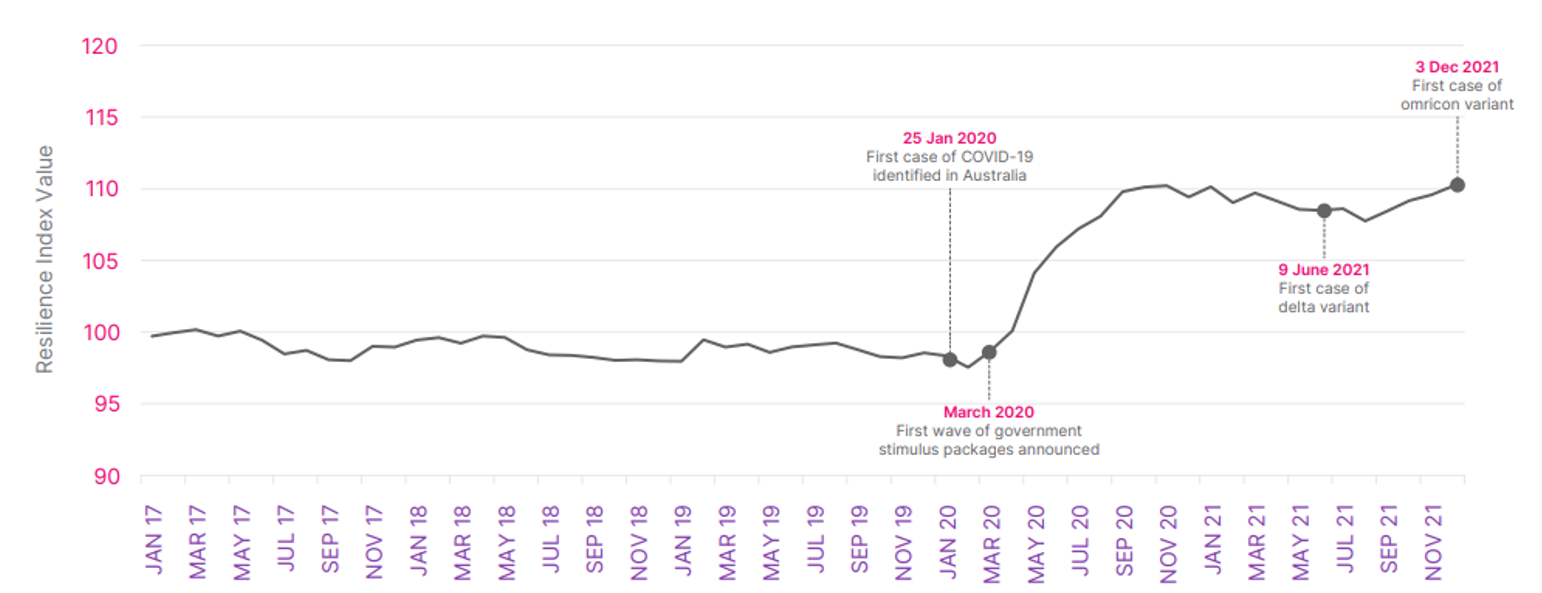

MYOB conducted their “Success Report” for the March quarter which surveys 500 SME owners and operators to gauge the environment in which SMEs are currently operating. As we begin to adapt to COVID-normal, looking back at the last two years provides a good insight into how SMEs have had to adapt to public health measures and endure hardship. The report provides an optimistic outlook on the future of SMEs with the MYOB Resilience Index finding that the Australian SME sector is now more resilient than before the COVID-19 pandemic. A reported 12% of SMEs have stated that they are now more resilient and better equipped to deal with future disruption due to the extensive intervention and government support.

MYOB SME Resilience Index

The enhanced level of resilience despite the past few years of uncertainty and unprecedented challenges have encouraged businesses to establish greater cash reserves, improved profitability and enhanced cash flows to ensure they are able to weather new obstacles they may face.

Whilst the general consensus was positive, some SMEs were not so fortunate to emerge as strongly. Government support and economic stimulus were the driving force behind many businesses staying afloat during the pandemic. Some SMEs stated however that they would have faired better had they received more targeted sector-specific support and funding.

The next step for SMEs is to shift from simply surviving the pandemic, to taking the opportunity to build and grow in a more stable environment, whereby living with COVID-19 is the new normal and business operations are no longer hindered by harsh lockdowns and restrictions.

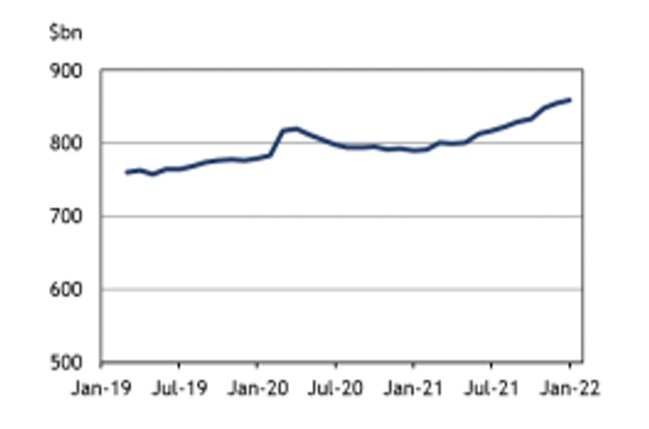

The data from the Australian Prudential Regulatory Authority further substantiates the strength of businesses as they continue to seek funding. Lending to non-financial businesses increased by 0.5% in January, equating to $4.6bn. Despite the reported deterioration in business conditions during that period due to the Omicron wave, business confidence and lending remained elevated as many believed the effects would be short-term.

Non-financial Businesses

Global inflationary pressures are forcing central banks to raise interest rates.

The US Federal Reserve voted this week to raise the interest rate from 0.25% to 0.50%. It is the first time the Fed has raised interest rates since 2018, but it expects to do so six more times this year to curb the effects of inflation and reach an interest rate of 2%.

The move comes as various economic indicators have continued to improve. A significant reduction in the unemployment rate, coupled with the elevated rate of inflation as a result of supply chain pressures and demand imbalances due to the global pandemic, is flagging the need for monetary policy intervention.

In addition to these challenges, the Russian invasion of Ukraine poses further uncertainty and fear within economic markets. The Federal Reserve has taken the stance that implications for the US economy as a result of this ongoing conflict remain highly uncertain, despite the likelihood that it will at the very least continue to create upward pressure on inflation.

With the committee's objective to achieve maximum employment and inflation at 2%, they have decided to raise the target interest rate, with the intention of continuing to do so whilst inflation remains well above the target range.

Similarly, the Bank of England this week voted to increase the bank rate by 0.25% to 0.75%. Like the US, the committee expected inflation to dissipate over time before the Ukraine conflict presented greater uncertainty and disruption. The invasion has led to further large increases in widespread pricing, creating ambiguity in their economic outlook and response. CPI inflation currently sits at 5.5% in the UK, and they too have 2% target. The committee is also of the view that further tightening of its monetary policy may be appropriate in the months ahead, although this is dependent on how medium-term inflation evolves.

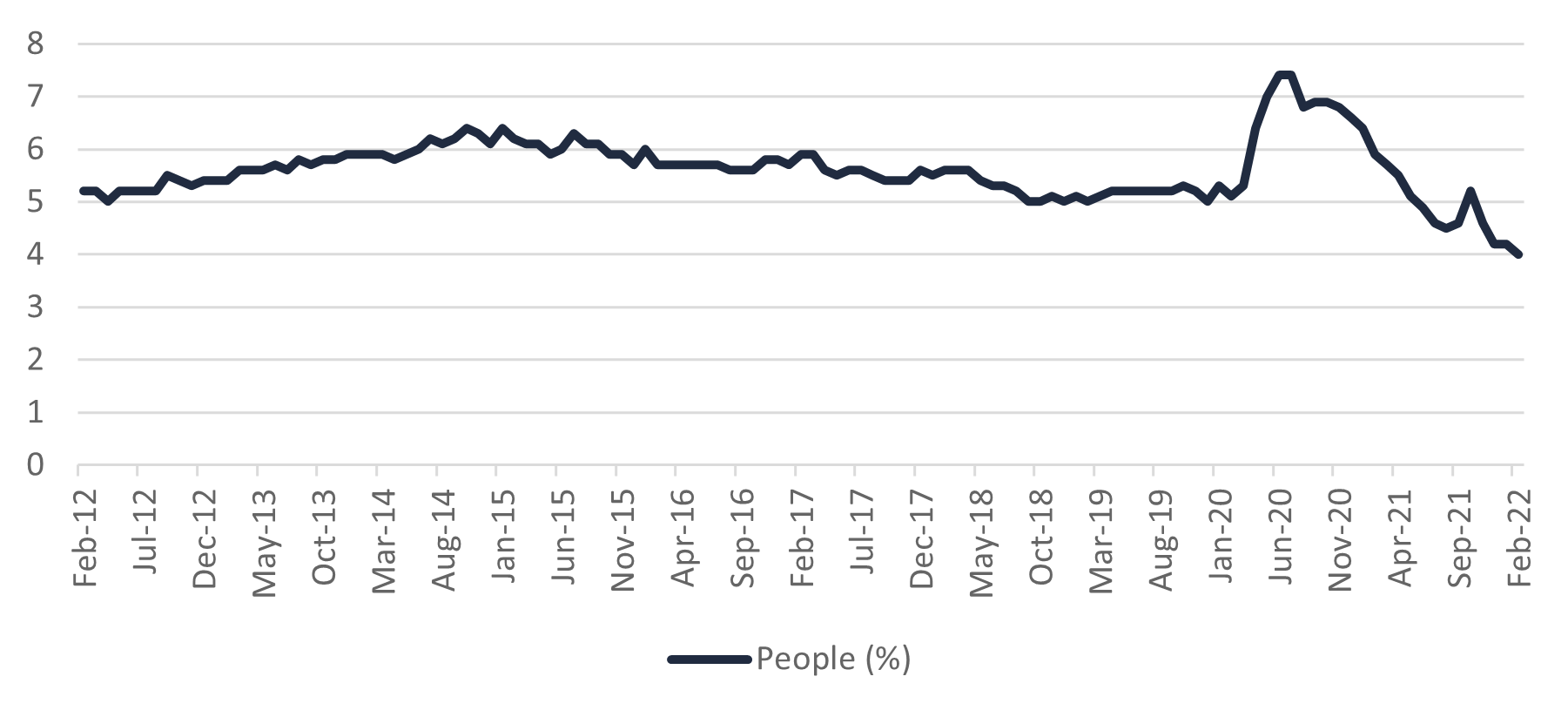

The Australian Bureau of Statistics released the Labour Force Data for February 2022 this week, illustrating the continued growth and strength in the current labour market:

The unemployment rate fell 0.2% to 4%

The participation rate increased to 66.4%

Employment increased by 77.4k to 13,372,000

Employment to population ratio increased to 63.8%

The underemployment rate decreased to 6.6%

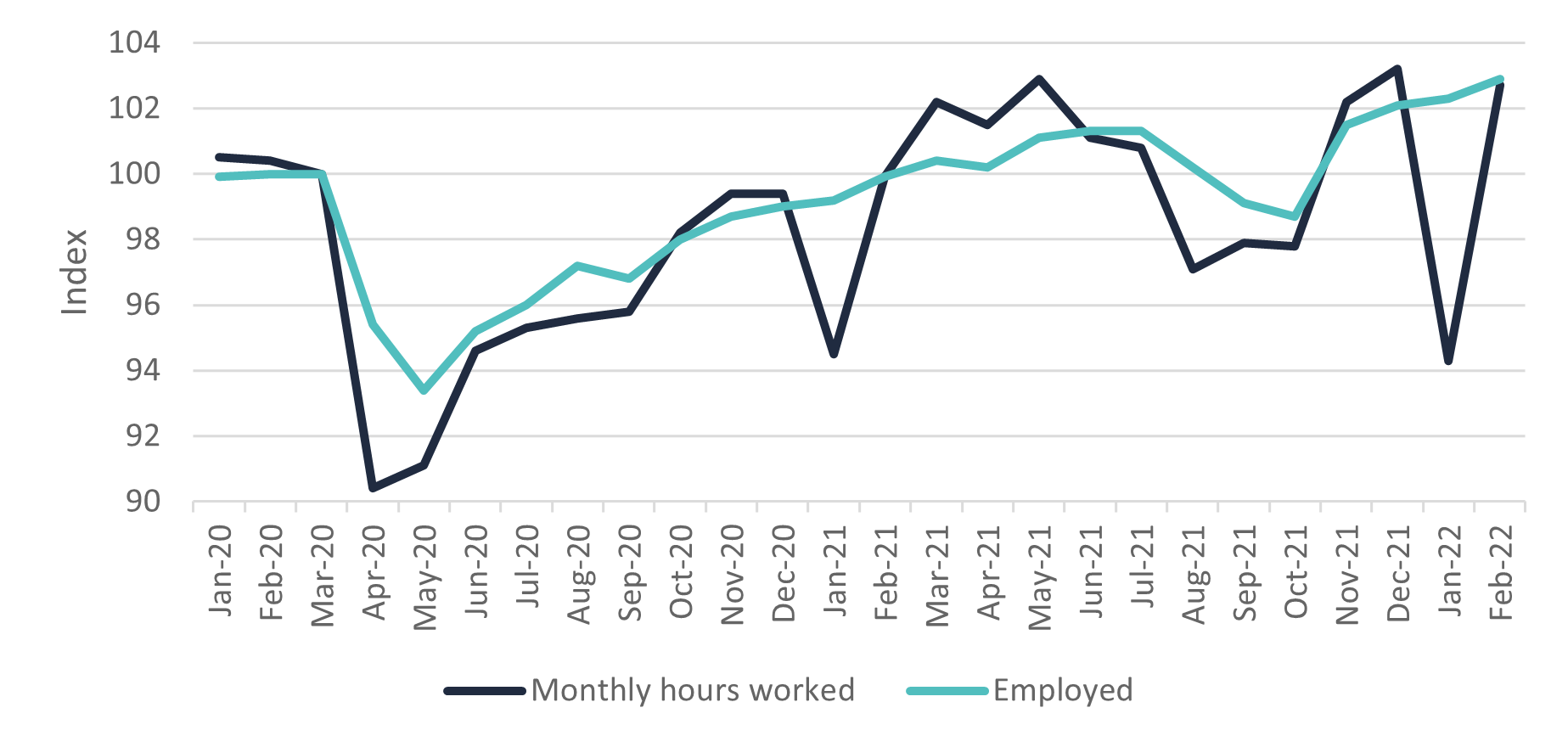

Monthly hours worked increased by 8.9%.

The unemployment rate dropped to its lowest level since August 2008, which is only the third time in the history of the monthly survey that the unemployment rate has been this low.

Unemployment Rate, Seasonally Adjusted

The monthly hours worked had a significant uptick with an 8.9% increase from the month before. This followed the decrease reported in January when there was an unusually large number of workers either on sick or holiday leave. The level still sits 0.5% below December, slightly lower than the May pre-Delta high which demonstrates the lengthened strain the Omicron wave had caused. The number of employed people working limited hours or none at all due to illness was 80% higher than what would usually be reported for February.

Seasonally Adjusted Employment & Monthly Hours Worked

It is also expected that the opening of international borders will achieve further expansion in the labour market in the months ahead. With the labour market continuing to tighten at a rapid pace, it is expected that there will be a boost in wage growth, which is likely to trigger the RBA to increase rates in the near future.

Prior to the conflict in Ukraine, the belief seemed to be that inflation would somewhat normalise without intervention from the central banks. This has not been the case. Inflation has continued, even as supply chains free up, and with an additional supply side impact in the energy sector further increasing inflationary conditions. As a result, we have seen the US and UK lift their interest rates, with more flagged.

Given the current Australian economic environment — with the unemployment rate hitting an all time low and creating a tight labour market, while inflation sits consistently higher than the RBA’s target range — we would expect to see a rate rise come this year. Despite the RBA’s indication that they are willing to remain patient and not introduce a rate rise in the near term, we as a team are expecting that this may have to come in the coming months. The March 2022 quarter CPI data is released on the 27th of April, a week before the May RBA meeting. We expect this will be a key talking point at the meeting. Governor Lowe had stated that the RBA were keen to see a couple of CPI data points before taking Monetary Policy action. A significant rise in CPI, which we believe will be driven by a significant uptick in energy prices, specifically fuel, in the March quarter could force their hand.

On a portfolio level, we are progressing well with the final legal documentation for the three additional transactions and look forward to closing these off in the next few weeks.

Until next week,

Brett Craig

Portfolio Manager

Sources:

1 MYOB – Success Repot – March 2022 - https://www.rba.gov.au/media-releases/2022/mr-22-05.html

2 APRA – Monthly Authorised Deposit-Taking Institution Statistics – January 2022 - https://www.apra.gov.au/sites/default/files/2022-02/Monthly%20Authorised%20Deposit-taking%20Institution%20Statistics%20Highlights%20January%202022.pdf

3 Federal Reserve Issues FOMC Statement - https://www.federalreserve.gov/newsevents/pressreleases/monetary20220316a.htm

4 Bank of England Monetary Policy Summary, March 2022 - https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2022/march-2021

5 Labour Force – February 2022 - https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release#methodology

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887). Aura Funds Management Pty Ltd is the Trustee of all the Funds mentioned and a subsidiary of Aura Group Pty Ltd.

Any financial product advice given in this report is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs. Aura does not guarantee the performance of its funds, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report is based on the information provided to Aura by third parties that may not have been verified. Aura believes that the information is reliable but does not guarantee its accuracy or completeness. Aura is not able to give tax advice and accordingly, investors should obtain independent advice from an accountant and/or lawyer before making any decision based on the tax treatment of its investors. You must read the Fund Fact Sheet or Information Memorandum and seek professional advice before making a decision to invest in any of the funds.

This current economic environment is heating up, with employment and inflation levels reaching all-time highs in the post-pandemic environment.

The Aura Private Credit team reviews data from the ABS that shows a subdued economic environment, with slight drops in inflation, household savings...

The current environment affords private equity managers the opportunity to deploy capital at cheaper valuations.

Subscribe to News & Insights to stay up to date with all things Aura Group.